We’ve all had those thoughts. The thoughts like, “I can never do this” or “I feel like I’ve been doing this forever and haven’t seen any results”.

At times everyone feels defeated as they progress on the journey toward accomplishing financial goals and building wealth.

In our case, we have used our personal balance sheet as a source of insight and inspiration. We hope you do the same.

What is a balance sheet?

A balance sheet is a financial statement used mostly by companies and organizations but also people for creating a snapshot of their assets and liabilities (debts) at a specific point in time.

For more information and how to build your own personal balance sheet, check out this post.

Debt Relief with a Personal Balance Sheet

A balance sheet shows you where you are and what must be done.

When you first create a balance sheet, it shows you where you are financially.

It paints a picture of what is the combined value of your assets, your liabilities, and your net worth.

Both a positive or negative net worth can be very motivating to accomplish goals because you’ve now established the starting line.

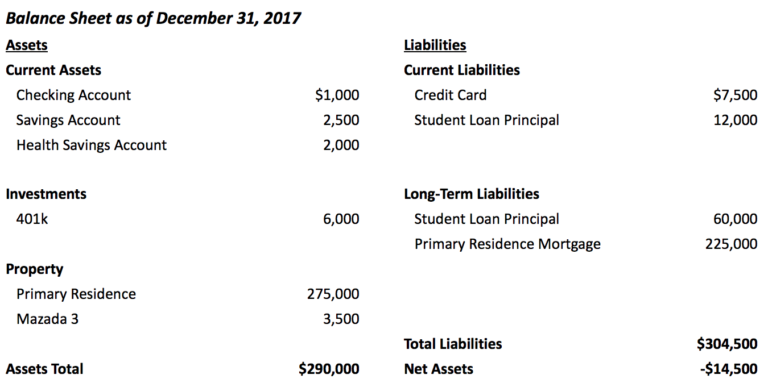

Here is an example of a balance sheet:

You may think, “Oh no! Net assets (net worth) is negative” but now you at least know that you have a negative net worth.

And, while this may feel like being kicked when you’re down, hopefully it will light a fire inside you to bring it from a negative to

Where You’ve Come From

The great thing about a balance sheet is that you can update it quarterly or annually or if there is a big financial change and see your progress from your earlier balance sheet.

After you’ve updated your balance sheet, you now have the ability to analyze every aspect of it.

Did your assets increase since the time you created your first balance sheet? What about your liabilities? Were you able to pay off some debt? How much did your net worth increase?

Looking at each of these changes on your balance sheet shows you that you are progressing on your path toward your financial goals.

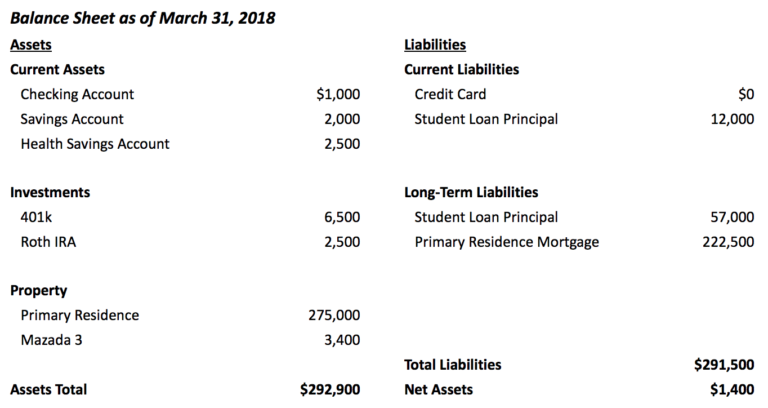

Here is an example of the previous balance sheet updated:

As you can see, there have been a few changes to the balance sheet since the last update.

Most notably, net worth (or net assets) has become positive.

Largely due to credit card debt being paid off, you get to feel good twice.

Once for paying off typically high-interest debt and second for having a positive net worth.

Create Achievable Goals

Once you’ve created or updated your balance sheet, ask yourself what are my goals from now until the next time I update my balance sheet?

If you have multiple iterations of your balance sheet, you know what you’ve been able to accomplish in the past.

Are you going to try and match that or exceed that accomplishment?

Having these goals, even if they are small, is a great way to keep you motivated towards the ultimate goal, financial freedom.

BONUS

One of the best parts of the balance sheet from a personal perspective is that you can update it whenever and as often as you like.

Just paid off a credit card? Update your balance sheet.

Feeling down about your current situation and that you’ll never reach your goals? Update the balance sheet.

Even if there hasn’t been much change or maybe even a negative change, updating your balance sheet will keep you focused and help keep you practicing the good habits you’ve established to attain these financial goals.

Final Thoughts

Creating a personal balance sheet is an awesome way to track your financial progress and keep you motivated to reach your goals.

Today we talked about the reasons why a personal balance sheet is vital for achieving financial freedom. To recap:

- Conquer Your Debt: you know we love that phrase around here and a personal balance sheet is an awesome way to track and celebrate your debt payments.

- Track Your Progress: If you ever

wan to move forward, you need to understand where you’ve come from. Personal balance sheets can be tracked from year to year so you can get a great snapshot of your financial accomplishments. - Create Achievable Goals: A personal balance sheet is a great way to get real about your financial goals. Since you know how you’ve done in the past, you are more likely to set achievable goals for the future.

- Flexibility: a personal balance sheet is awesome because it is flexible. You can update whenever you want!

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.