If you’re like us, you’ve received countless advertisements offering student loan refinancing.

But, what does it mean to refinance your student loans?

Do you save any money by doing it?

Maybe.

There are some complexities when it comes to student loan refinancing because a lot of people receive loans from the federal government.

In this post, we’ll discuss the following:

- The definition of refinancing and what it means

- Why would you want to refinance your student loans?

- Areas where refinancing will change your loan

- Student loan refinancing basics

- Where to refinance your student loan

- Things to consider before refinancing

What is Refinancing ?

Let’s start with financing actually.

We are the Frugal Financiers after all.

In this case, financing is the action of locating a source of money for a specific purchase.

Under this definition of financing, you can think of financing as funding or where you’re going to get the money.

You actually finance or fund every purchase through different means.

A burrito is financed by the cash in your pocket.

The purchase of a house is usually financed through a cash down payment and a mortgage from a bank or other institution.

So, you originally financed your tuition and maybe other stuff like books, rent and food with a specific loan or loans.

Now, you want to refinance those original purchases with a new loan.

One quick note.

Consolidation is not the same thing as refinancing.

Consolidation is the combination of loans at a rate that equals the weighted-average of loans being combined.

Why would you want to refinance your purchase?

The hope is that you’ll be able to secure a new loan with better financing terms.

Why You Might Want to Refinance Your Student loans?

Student loan refinancing is all about saving some money for most people.

There are other terms that you may want to change too.

But, the main goal is usually spending less money on interest.

How do you do that?

A lower interest rate.

When most people talk about student loan refinancing and how it can save you money, they are talking about a lower interest rate.

Your interest rate is the amount of money you pay the lender for lending you the money.

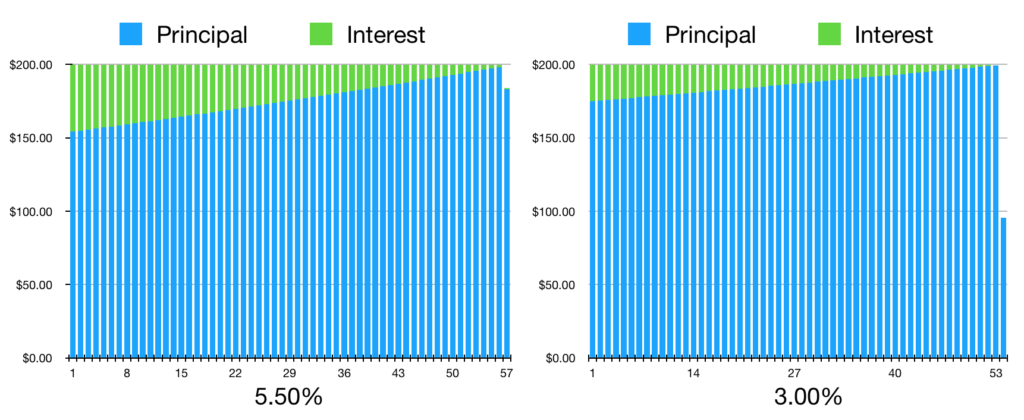

So, you have an average interest rate on your current student loans that is 5.5% APR.

APR = annual percentage rate

The math behind interest expense calculations can get complex so we use some basic math for illustrative purposes.

If you had $10,000 of student loan debt and only paid interest, over the next year you’d pay roughly $550.

Let’s say a bank offers to refinance your college education purchases with a loan at 3% APR.

Now, that $10,000 balance is going to cost $300 in interest expense each year.

So, you can save $250.

Not bad.

This is a basic example because you’re likely paying down the balance of your loans each month.

You will save less than $250 in the example but you will still save money.

We made a

Again, it’s not exact and for illustrative purposes.

You’ll quickly see that with a 3.00% interest rate you pay less and you pay off your loan faster.

In this basic example, the difference is paying $1,384 of interest with a 5.5% interest rate and paying $696 of interest with a 3.00% interest rate.

That’s how you save money by refinancing.

There are other areas where your financing terms may change though.

Areas Where Refinancing May Change the Terms of Your Loan

We’ll give you a 2.00% interest rate for a 3 year term and 2.75% for a 5 year term loan.

The above sentence is similar to an advertisement for student loan refinancing that we’ve seen.

Essentially, you can pay off the loan over the course of 3 years at a 2.00% interest rate or pay it off at 2.75% over 5 years.

There are a few different places where you may get different financing terms with a new student loan.

The obvious one is your interest rate.

But, the length of loan repayment may increase or decrease.

And, your minimum payment amount will likely also change.

Those are the on-the-surface main areas that may change if you refinance your student loans.

One last term that may or may not change is the type of interest rate, specifically, fixed or variable.

A fixed

For example, if the rate index moves up 1.00%, the interest rate on your loans also move up 1.00%.

This can cause you to spend extra money on interest.

But, variable rate loans tend to have lower rates than comparable fixed

Student Loan Refinancing Basics

You payment is a calculation that involves the length of loan repayment, interest rate, and loan balance.

So, if your interest rate changes, your payment will also change.

Lower interest rate = lower payment.

And, if the length of loan repayment changes, your payment will also change.

Shorter length of loan repayment = higher payment.

These are the 3 basics of student loan refinancing that you need to know.

What is the interest rate?

How long will you be making payments on the loan?

What is the monthly payment?

Other Things to Consider B efore Refinancing

Up to this point, student loan refinancing is looking pretty good.

Take out a new loan with a lower interest rate and save some money.

You can even use that saved money to pay off your loans faster.

But, there are some

Federal loans come with special protections and other potential benefits.

If something happens and you cannot make your loan payments, a federal loan has built-in ways to handle the situation.

With a federal loan, you can apply for payment postponement.

You cannot typically do this with a private lender.

Instead, you will have to discuss your options with your lender.

Additionally, there may be a way that you can have your loans forgiven under the federal student loan program.

This is not the case for private loans.

Remember to also consider if your new interest rate will be set at a fixed or variable rate.

For more on the differences between private and federal student loans, check out this post by the Federal Student Aid Office.

You may be asking: Why don’t I just refinance with the federal government?

Unfortunately, the federal government doesn’t refinance loans.

Where to Refinance Your Student Loans

Since the federal government isn’t going to give you a new loan, you’ll have to look for a private lender.

There are many different private lenders offering student loan refinancing.

A quick search online will show results for student loan refinancing lenders.

We suggest that you create a list of the different lenders that you are interested in receiving a loan.

You can also check out websites like Credible and NerdWallet for some comparisons between different lenders.

Final Thoughts

Although refinancing seems simple on the surface, there is a lot to think about before you refinance your student loans.

First, you have to understand refinancing and the basics of student loan refinancing.

Then, consider how refinancing might change your personal situation.

Last, you have to find the best lender for you.

This isn’t something that you should do in one day.

Take some time and think through the process.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.